Gross Domestic Product (GDP) is a key indicator of a nation’s economic strength. It measures the total value of goods and services produced within a country in a given year. This metric helps analysts and policymakers understand the health and growth potential of an economy.

This article provides a comprehensive list of the strongest economies in Europe based on their GDP. The data is sourced from reputable organizations like the International Monetary Fund (IMF), ensuring accuracy and reliability. Readers will gain insights into the concept of nominal GDP and its significance in assessing a market’s performance.

From historical trends to future projections, the content explores how these economies have evolved. It also highlights key players like Germany and the United Kingdom, offering a detailed look at their economic landscapes. Whether you’re a student, investor, or simply curious, this guide offers valuable information in a friendly and engaging manner.

Key Takeaways

- GDP measures a nation’s economic output and growth.

- This article ranks the strongest economies in Europe.

- Data is sourced from reliable organizations like the IMF.

- Nominal GDP is a key metric for economic analysis.

- Historical and future economic trends are explored.

- Germany and the United Kingdom are highlighted as major players.

Introduction to European GDP Rankings

Understanding a nation’s economic health starts with analyzing its Gross Domestic Product (GDP). This metric represents the total value of goods and services produced within a country in a specific time frame. It’s a vital tool for assessing the strength and growth potential of an economy.

Defining GDP and Economic Indicators

GDP is often referred to as the market value of all final goods and services produced by a nation in a given year. It serves as a primary indicator of economic performance. Analysts use it to compare the economic output of different countries and track changes over time.

There are two main types of GDP: nominal and real. Nominal GDP measures the value of goods and services at current market prices. Real GDP, on the other hand, adjusts for inflation, providing a clearer picture of economic growth. For example, the European Union uses both metrics to evaluate member states’ economic health.

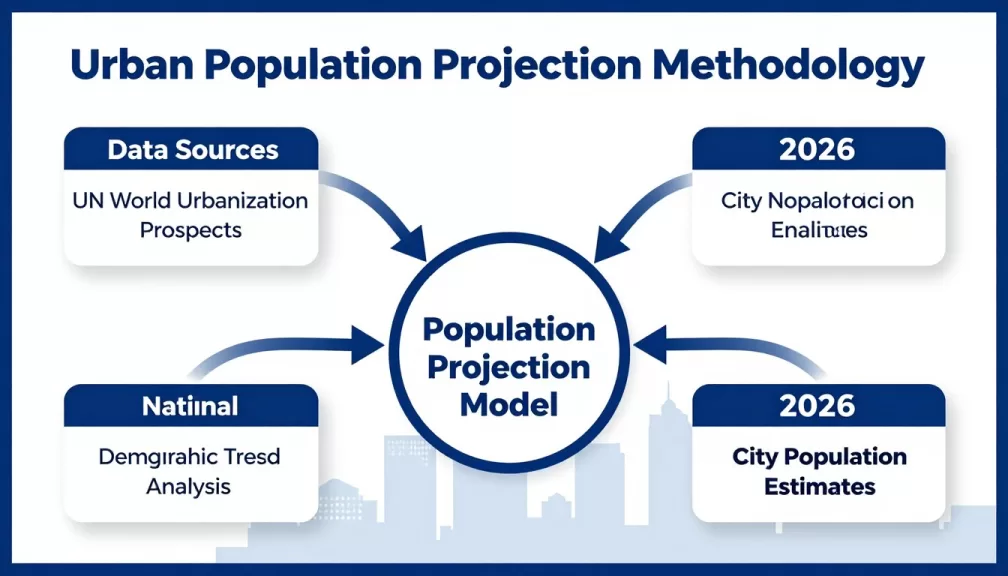

Understanding the Data Sources

Reliable data is crucial for accurate GDP analysis. Organizations like the International Monetary Fund (IMF) and Eurostat provide comprehensive statistics. These institutions calculate GDP using official exchange rates, ensuring consistency across different economies.

By understanding these sources, readers can better interpret GDP rankings and their implications. This knowledge is essential for anyone interested in the economic dynamics of the European Union and beyond.

Key Sectors Shaping National Economies

Industries and innovation are the driving forces behind economic success. The strength of a country’s economy often depends on the performance of its key sectors. From manufacturing to technology, these industries shape the gross domestic product and influence global rankings.

Major Industries Driving GDP Growth

Manufacturing, services, and technology are among the primary contributors to GDP. For instance, Germany’s industrial sector, known for its automotive and machinery exports, plays a significant role in its economic stability. Similarly, the United Kingdom’s finance and tech industries have bolstered its position as a global leader.

Each year, these sectors evolve, impacting the overall economy. A comprehensive list of industry contributions can help explain why some nations outperform others. Understanding these dynamics is crucial for policymakers and investors alike.

Role of Innovation and Technology

Innovation is a cornerstone of sustainable economic growth. Countries that invest in research and development often see long-term benefits. The UK’s focus on tech startups and Germany’s advancements in renewable energy are prime examples.

Technological advancements not only boost productivity but also create new opportunities. As industries adapt to changing demands, they drive GDP growth and enhance a nation’s competitive edge. This interplay between innovation and industry is reshaping the global economic landscape.

Historical Evolution of European Economies

From post-war recovery to modern advancements, Europe’s economies have transformed dramatically. Over the decades, key events and policies have shaped the domestic product of nations across the continent. Understanding this evolution provides context for today’s economic standings.

Economic Milestones Over Decades

Europe’s economic journey began with post-World War II rebuilding. The Marshall Plan played a crucial role in revitalizing war-torn nations. By the 1970s, industrial growth had become a cornerstone of many economies.

The 1990s marked a turning point with the introduction of the Euro. This currency shift unified markets and boosted trade. For example, Germany’s economy thrived due to its strong industrial base and export-driven strategy.

In the 2000s, the global financial crisis tested resilience. Despite challenges, countries like the UK adapted by focusing on finance and technology. These milestones highlight the adaptability of Europe’s economies.

Impact of Political and Currency Shifts

Political changes have also influenced economic growth. The fall of the Berlin Wall in 1989 opened new opportunities for Eastern Europe. Countries like Poland and Hungary transitioned from centrally planned to market-driven economies.

Currency shifts, such as the adoption of the Euro, streamlined trade and investment. However, not all nations benefited equally. Greece’s debt crisis in the 2010s underscored the complexities of a shared currency.

Today, Europe’s economy reflects a blend of historical resilience and modern innovation. By examining these shifts, we gain a deeper understanding of how past events continue to shape the present.

Top 10 European Countries by GDP: Detailed Rankings

Economic strength in Europe is often measured by the Gross Domestic Product (GDP), a vital metric for understanding a nation’s financial health. This section provides a detailed list of the strongest economies in the region, based on the latest IMF data. Each country’s ranking reflects its economic stability, industrial prowess, and growth potential.

Germany: Leading with Stability

Germany consistently tops the rankings with a GDP of over $4.5 trillion. Its robust industrial sector, particularly in automotive and machinery exports, drives this economic dominance. The country’s focus on innovation and sustainable practices ensures long-term stability.

For example, Germany’s renewable energy initiatives have positioned it as a global leader in green technology. This commitment to innovation, combined with a strong export market, solidifies its position as Europe’s largest economy.

United Kingdom and France: Key Market Players

The United Kingdom and France are pivotal players in Europe’s economic landscape. The UK, with a GDP of $3.38 trillion, thrives on its finance and technology sectors. London’s status as a global financial hub contributes significantly to its economic output.

France, with a GDP of $3.05 trillion, excels in industries like aerospace, tourism, and luxury goods. Both nations benefit from diverse markets and strategic investments, making them indispensable to the region’s gross domestic product.

Emerging Economies in the List

Emerging economies like Poland and Belgium are making strides in the rankings. Poland, with a GDP of $809 billion, has seen rapid growth due to its manufacturing and tech sectors. Similarly, Belgium’s strategic location and strong trade ties contribute to its $644 billion GDP.

These nations demonstrate how innovation and strategic planning can elevate a country’s economic standing. Their inclusion in the list highlights the dynamic nature of Europe’s economy.

| Country | GDP (Nominal, 2023) |

|---|---|

| Germany | $4.526 trillion |

| United Kingdom | $3.381 trillion |

| France | $3.052 trillion |

| Italy | $2.301 trillion |

| Spain | $1.620 trillion |

| Netherlands | $1.154 trillion |

| Switzerland | $884.94 billion |

| Poland | $809.201 billion |

| Belgium | $644.783 billion |

| Sweden | $584.96 billion |

Economic Projections and Future Trends

Looking ahead, Europe’s economic landscape is poised for significant shifts. Financial institutions like the IMF project steady growth, with the EU’s real GDP expected to rise by 0.9% in 2024 and 1.5% in 2025. These projections highlight the resilience of the region’s economy despite global challenges.

Several factors will shape these trends. Technological advancements, policy reforms, and evolving market dynamics are key drivers. For instance, the United Kingdom’s focus on innovation and sustainable practices is expected to bolster its economic performance in the coming year.

Anticipated Growth Patterns

Growth patterns across Europe will vary. Countries like Germany and France are projected to maintain steady growth, driven by their strong industrial and tech sectors. Emerging economies, such as Poland, are also expected to see significant gains due to increased investment in manufacturing and technology.

According to the IMF, the euro area’s GDP is forecasted to grow by 0.8% in 2024, with further acceleration in 2025. This upward trend reflects the region’s ability to adapt to changing global conditions.

Factors Influencing Future GDP Rankings

Innovation and policy shifts will play a crucial role in shaping future GDP rankings. Countries that invest in research and development are likely to see long-term benefits. For example, Germany’s advancements in renewable energy and the UK’s tech sector are expected to drive economic growth.

Market dynamics, such as trade and investment flows, will also influence rankings. The EU’s exports are projected to grow by 1.4% in 2024, contributing to overall economic stability. These factors, combined with strategic policy decisions, will determine the future of Europe’s gross domestic product.

Comparative Analysis and Data Insights

Analyzing economic performance requires a deep dive into key metrics like GDP and market dynamics. This section provides a detailed comparison of nominal and real GDP, evaluates data from reputable sources, and explores how market price fluctuations influence economic measurements.

Comparing Nominal vs. Real GDP

Nominal GDP measures the value of goods and services at current market prices. It’s useful for comparing the size of different economies at a specific point in time. However, it doesn’t account for inflation, which can distort long-term comparisons.

Real GDP adjusts for inflation, providing a clearer picture of economic growth. For example, the European Union uses real GDP to assess the performance of member states over time. This metric is crucial for understanding whether a country’s economy is genuinely expanding or just experiencing price increases.

Evaluating Data from IMF and Euro Statistics

Reliable data is essential for accurate economic analysis. Organizations like the IMF and Eurostat provide comprehensive statistics on gross domestic product. These sources use standardized methods, ensuring consistency across different nations.

For instance, the IMF’s 2023 report highlights Germany’s nominal GDP of $4.92 trillion, while its real GDP growth rate stands at 0.8%. Such data helps policymakers and investors make informed decisions about economic strategies and investments.

Understanding Market Price Fluctuations

Market price fluctuations can significantly impact GDP calculations. For example, a sudden increase in oil prices can inflate nominal GDP in oil-exporting nations like Norway. However, this doesn’t necessarily reflect real economic growth.

Currency exchange rates also play a role. The United Kingdom’s GDP in USD terms can vary based on the GBP-USD exchange rate. Understanding these factors is crucial for interpreting GDP data accurately and making meaningful comparisons.

Conclusion

The strength of a nation’s economy often reflects its ability to adapt and innovate. Throughout this article, we’ve explored how historical trends, key sectors, and market dynamics shape the domestic product of leading nations. Understanding both nominal and real GDP is essential for evaluating economic health and growth potential.

The European Union continues to play a pivotal role in driving global markets. Nations like Germany and the United Kingdom demonstrate how innovation and strategic investments can sustain economic stability. Emerging economies, such as Poland, also highlight the importance of adaptability in a rapidly changing world.

This list of economic leaders offers valuable insights into the strengths and challenges faced by each country. Whether you’re an investor, student, or simply curious, these rankings provide a clear picture of Europe’s economic landscape. For more detailed data and analysis, explore further resources on this topic.