The strength of a nation’s currency is a significant indicator of its economic health, stability, and global influence. In the world of international finance, a strong currency can be a powerful tool, facilitating trade, investment, and travel.

While discussions of strong currencies often focus on the US dollar and Asian currencies, Europe is home to several of the world’s most valuable currencies. The value of these currencies can fluctuate based on various economic factors, making it essential for travelers, investors, and businesses to stay informed.

As we explore the top European countries with the strongest currencies, we’ll discover some surprising entries and gain insights into the factors that contribute to a currency’s strength. Understanding these dynamics can help individuals and organizations make informed decisions in international markets.

Key Takeaways

- The strength of a currency reflects a nation’s economic health and global influence.

- Europe hosts several of the world’s most valuable currencies.

- Currency values fluctuate based on various economic factors.

- Understanding currency strength helps travelers, investors, and businesses make informed decisions.

- The analysis will preview the top European countries with the strongest currencies.

Understanding Currency Strength in Europe

Currency strength is a vital indicator of a country’s economic stability and global trading power in Europe. It reflects the economic health, stability, and global trading power of the country.

What Makes a Currency Strong?

A strong currency is typically backed by a robust economy with low inflation, high foreign reserves, and a favorable trade balance. Economic stability is crucial, as it allows for steady growth and stable prices, which in turn strengthens the currency. Foreign reserves act as a financial safety net, keeping the currency stable even during market volatility.

How Currency Value Affects National Economies

The value of a currency has a significant impact on a nation’s economy. A strong currency can make imports cheaper but may reduce the competitiveness of exports. On the other hand, a weak currency can boost exports but make imports more expensive. The impact of currency value is seen in various aspects, including tourism, foreign investment, and national debt.

- A strong currency can reduce import costs but may make exports less competitive internationally.

- Currency values impact tourism, as a stronger currency makes a country more expensive for visitors but gives citizens more purchasing power abroad.

- The strength of a currency affects foreign investment, with stable, strong currencies typically attracting more international capital.

Understanding these dynamics is essential for businesses and policymakers to adapt their strategies based on currency values, including hedging against currency risks in international trade.

Top 10 European Countries with the Highest Currency

A closer look at Europe’s currency strength reveals a diverse group of nations with robust economic fundamentals. The strength of a currency is often a reflection of a country’s economic health, stability, and global trade influence.

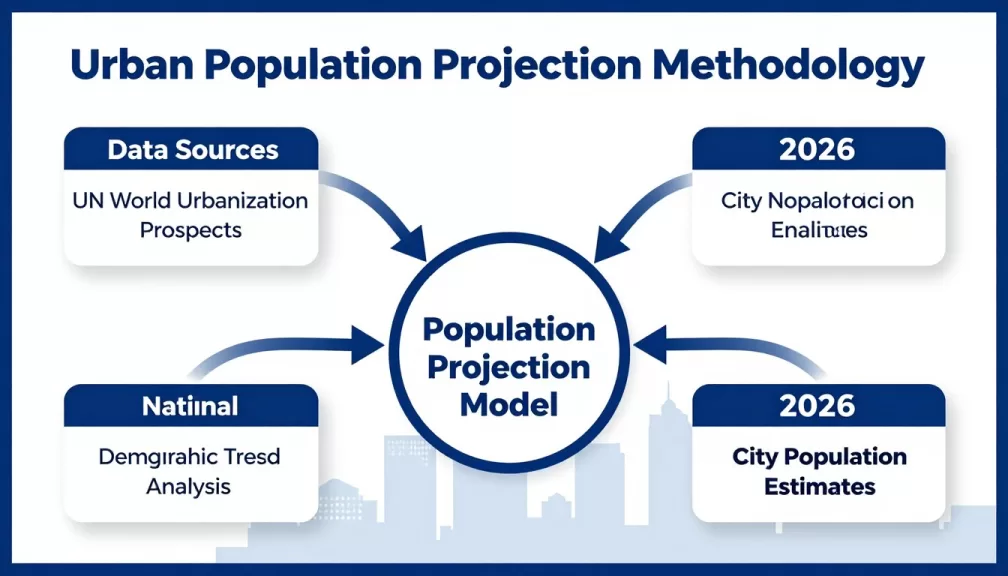

Methodology for Ranking European Currencies

To determine the top 10 European currencies, we examined the exchange rates of various European countries against the US dollar. The ranking is based on the average exchange rate over a specific period, taking into account the currencies’ stability and global acceptance. According to the data, the top 10 strongest global currencies include several European nations.

| Rank | Currency | Country |

|---|---|---|

| 5 | British Pound (GBP) | United Kingdom |

| 6 | Gibraltar Pound (GIP) | Gibraltar |

| 8 | Swiss Franc (CHF) | Switzerland |

| 9 | Euro (EUR) | Europe |

Overview of Europe’s Strongest Currencies

Europe’s strongest currencies are not limited to the Eurozone; non-EU countries like Switzerland and the UK also feature prominently. The geographical distribution of strong currencies across Europe shows a mix of Western and Northern European countries. Historically, currencies like the British Pound and Swiss Franc have maintained their value over time, making them significant in international trade and finance.

The upcoming sections will delve into each of these currencies, examining the economic factors behind their strength and their role in the global economy.

United Kingdom – British Pound (GBP)

As the fifth-strongest world currency in 2024, the British Pound has demonstrated remarkable resilience. The pound is widely recognized for its stability and liquidity, making it a popular choice among investors and traders alike.

Economic Factors Behind the Pound’s Strength

The strength of the British Pound can be attributed to the UK’s robust economy, which is one of the world’s largest by Gross Domestic Product (GDP). The UK’s economic stability and its reputation as a global financial hub contribute to the pound’s value.

The Impact of Brexit on the British Pound

The Brexit referendum in 2016 marked a significant turning point for the British Pound. The uncertainty surrounding the UK’s departure from the EU led to volatility in the pound’s exchange rate. Despite this, the pound has shown resilience, and its current value is influenced by new trade agreements and economic policies post-Brexit.

Key moments of volatility since the 2016 Brexit referendum include the initial drop in value following the referendum result, and more recently, the impact of the ‘mini budget’ by then-PM Liz Truss, which triggered a major drop in the pound’s value. The long-term implications of Brexit on the pound’s status as a global currency are still being assessed.

Switzerland – Swiss Franc (CHF)

The Swiss Franc’s strength is a hallmark of Switzerland’s economic stability. The Swiss National Bank (SNB) plays a crucial role in maintaining this stability through various measures, including monetary policy implementation, price stability maintenance, and supervision of banks and the financial sector.

Switzerland’s Banking System and Currency Stability

Switzerland’s banking system is renowned for its stability and prudence, factors that significantly contribute to the Swiss Franc’s strength. The SNB’s effective supervision and regulation of financial institutions bolster investor confidence. The country’s political neutrality and economic robustness further enhance the currency’s value.

The Swiss Franc as a Safe-Haven Currency

The Swiss Franc is considered a safe-haven currency, appreciating during times of global economic uncertainty. Historical data shows significant appreciation during crises like the 2008 financial crisis and the COVID-19 pandemic. Investors view the Swiss Franc favorably due to Switzerland’s political stability and economic prudence. However, this safe-haven status poses challenges for Switzerland’s export-oriented economy, as a strong currency can make exports more expensive. The SNB has attempted to manage excessive appreciation through various monetary policies.

Gibraltar – Gibraltar Pound (GIP)

The Gibraltar Pound (GIP) is among the top European currencies, driven by its peg to the British Pound (GBP). Gibraltar, a British Overseas Territory, enjoys a stable economy largely due to its close relationship with the UK.

Relationship to the British Pound

The GIP is pegged to the GBP at a fixed rate, ensuring that the value of the GIP mirrors that of the GBP. This currency stability is a significant factor in Gibraltar’s economic strength, as it provides a secure environment for businesses and investors. The close economic ties between Gibraltar and the UK also facilitate trade and financial transactions between the two territories.

Gibraltar’s Economy and Currency Strength

Gibraltar’s economy is diverse, with key sectors including financial services, tourism, shipping, and online gambling. Its status as a low-tax jurisdiction has attracted numerous businesses, contributing to its economic prosperity. The territory’s per capita GDP is among the highest in Europe, reflecting its strong economic performance. However, Gibraltar faces challenges such as Brexit-related issues and complex relations with Spain, which can impact its economy and currency value.

The Eurozone Countries

As one of the world’s major reserve currencies, the euro’s value is shaped by the diverse economic policies of its member countries. The euro is used by 20 of the 27 European Union member states, making it a significant player in global currency markets.

How the Euro Compares to Other Global Currencies

The euro’s value is influenced by the economic performance of the Eurozone as a whole. Compared to other major currencies like the US dollar and the yen, the euro’s exchange rate is affected by the collective economic policies of its member states. This makes it unique in the world of international finance.

The euro’s status as a global reserve currency is a testament to the economic integration of the European Union. Its value is closely monitored by investors and policymakers around the world.

The European Central Bank’s Role in Currency Stability

The European Central Bank (ECB) plays a crucial role in maintaining the stability of the euro. By overseeing monetary policy, the ECB ensures that inflation is kept under control, which in turn supports the euro’s value. The ECB’s actions have a direct impact on the euro’s exchange rate against other major currencies.

The ECB’s mandate differs from other central banks, such as the Federal Reserve, as it must balance the economic needs of multiple countries within the European Union. This requires careful management to maintain the euro’s reliability and currency strength.

Germany – Economic Powerhouse of the Eurozone

Germany stands as the economic powerhouse of the Eurozone, driving economic success through its robust export industry. As the largest economy in Europe, Germany’s influence on the Euro is significant.

Economic Influence on the Euro

Germany’s economic strength is a crucial factor in the Eurozone’s stability. The country’s export-driven economy plays a significant role in shaping the Euro’s value. Germany’s trade surplus, driven by its competitive export sectors, contributes to the Euro’s exchange rate.

Export-Driven Economy and Currency Value

Germany’s position as one of the world’s leading exporters drives its economic success. Key export sectors include automotive, machinery, and pharmaceuticals. Despite having a relatively strong currency, Germany has maintained export competitiveness through innovation and productivity. The country’s global trade relationships support its export economy and influence the Euro’s exchange rate.

The relationship between Germany’s trade surplus and the Euro’s exchange rate is complex. A strong Euro can present challenges for Germany’s export-oriented industries, but the country’s competitive edge helps mitigate this effect.

Luxembourg – Highest GDP Per Capita in Europe

Luxembourg stands out as a beacon of economic prosperity in Europe, boasting the highest GDP per capita. Its strategic location at the heart of Europe, coupled with a highly developed financial sector, contributes significantly to its economic strength.

Financial Services Sector and Currency Stability

The financial services sector is a cornerstone of Luxembourg’s economy, providing a stable source of revenue and contributing to the country’s currency stability. The sector’s robustness is a result of the country’s favorable business environment and stringent regulatory frameworks.

Currency stability is further enhanced by Luxembourg’s participation in the Eurozone, which provides a stable currency – the Euro – widely used in international transactions.

Luxembourg’s Role in the European Economy

Luxembourg plays a significant role in the European economy, particularly in financial markets and cross-border financial services. Its expertise in handling complex financial transactions makes it a hub for international investors.

The country’s economic diversification efforts beyond financial services, including a growing focus on innovation and technology, help maintain its exceptional prosperity and balance its national economic interests with broader Eurozone stability.

Denmark – Danish Krone (DKK)

The Danish Krone is one of Europe’s strongest currencies, backed by the country’s robust economic policies.

Denmark’s Economic Stability and Currency Strength

Denmark’s participation in the European Exchange Rate Mechanism II (ERM II) has pegged the Krone to the Euro, ensuring currency stability. The Krone is allowed to fluctuate within a narrow band, maintaining economic reliability.

The benefits of this peg include reduced exchange rate volatility, fostering a stable trade environment. However, it also presents challenges, such as limiting Denmark’s monetary policy flexibility.

The Krone’s Relationship with the Euro

The Krone’s peg to the Euro has been tested historically, particularly during economic crises. Denmark’s central bank has responded effectively, maintaining the peg and ensuring currency stability.

Denmark has held multiple referendums on adopting the Euro, with public opinion influenced by concerns over monetary autonomy. By maintaining the Krone, Denmark balances alignment with Eurozone policies while preserving its monetary independence.

Factors Affecting European Currency Values

European currency values are subject to various influences, ranging from economic performance to geopolitical tensions. Understanding these factors is crucial for investors and economists alike.

Economic Indicators That Influence Currency Strength

Economic indicators play a significant role in determining the strength of a currency. According to Nasdaq, a strong currency is defined as “A currency whose value compared to other currencies is improving, as indicated by a decrease in the direct exchange rates for the currency.” Key economic indicators include GDP growth rate, inflation rate, and unemployment rate. For instance, a country with a high GDP growth rate is likely to have a strong currency.

| Economic Indicator | Impact on Currency |

|---|---|

| GDP Growth Rate | Positive impact on currency strength |

| Inflation Rate | High inflation can weaken currency |

| Unemployment Rate | Low unemployment can strengthen currency |

Political Stability and Currency Performance

Political stability is another crucial factor that affects currency performance. Elections and changes in government can create short-term volatility in currency markets. Geopolitical tensions, such as those between Russia and Ukraine, can also impact European currencies. As noted by experts, “Political stability serves as a foundation for currency strength across European nations.”

Policy continuity or disruption can significantly affect investor confidence and currency performance. For example, a stable government with a clear economic policy can strengthen a currency, while political instability can lead to currency depreciation.

“The stability of a country’s political environment is crucial for maintaining a strong currency.”

In conclusion, both economic indicators and political stability are critical factors that influence European currency values. Understanding these factors can help investors make informed decisions.

Conclusion

Understanding the strongest currencies in Europe provides insight into the continent’s economic landscape. The top European countries with the highest currency value are characterized by robust economies, stable political systems, and a high standard of living.

The diversity of European monetary systems, from Eurozone members to countries maintaining their own currencies, contributes to the complexity of the continent’s economic environment. Factors such as economic indicators, political stability, and global events influence the strength of a currency and its exchange rate.

As the global economy continues to evolve, European currencies will remain crucial for travelers, investors, and businesses operating in the region. The strongest currencies in Europe are not only a reflection of national economic strengths but also play a significant role in the world economy.

In conclusion, the value and stability of European currencies will continue to be shaped by a combination of national and global factors, making it essential to monitor economic trends and developments in the region.